Introduction to Wells Fargo and its Flexible Credit Solutions

When it comes to managing your finances, having the right tools at your disposal can make all the difference. Enter Wells Fargo and its innovative credit solutions designed to empower your spending habits. Whether you’re looking to finance a new project, cover unexpected expenses, or simply want more flexibility in how you manage your money, Wells Fargo has options tailored just for you. With various offerings that cater to different needs and lifestyles, navigating through financial decisions can become less daunting. Let’s dive into what makes these credit solutions from Wells Fargo stand out and how they can transform the way you handle your finances.

Understanding the Different Types of Credit Options Available

Wells Fargo offers a variety of credit options tailored to different financial needs. Whether you’re looking for everyday spending power or funding for larger purchases, there’s something for everyone.

Credit cards are among the most popular choices. They provide flexibility and rewards on purchases. You can earn cash back, travel points, or other perks that suit your lifestyle.

For those seeking more substantial financing, personal loans are another option. These loans come with fixed rates and predictable monthly payments, making them ideal for planned expenses like home improvements or consolidating debt.

Home equity lines of credit (HELOCs) allow homeowners to tap into their property’s value. This flexible solution is perfect when unexpected costs arise or major projects need funding.

Each option has its unique features designed to empower your spending while keeping your financial goals in mind. Evaluating these offerings helps you find the best fit for your situation.

Benefits of Using Flexible Credit Solutions from Wells Fargo

Flexible credit solutions from Wells Fargo offer a range of benefits tailored to meet your financial needs. One significant advantage is the ability to customize repayment plans, allowing you to select options that fit your budget and lifestyle.

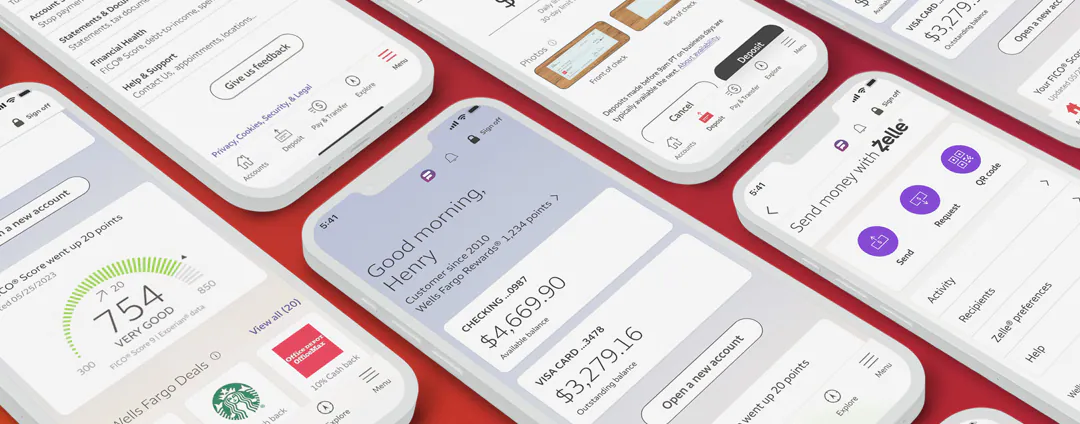

Another benefit is the convenience of managing your accounts through an intuitive mobile app. Track spending, make payments, and monitor balances effortlessly at any time.

Additionally, Wells Fargo provides competitive interest rates on various credit products. This can translate into savings over time compared to other lenders in the market.

Accessing funds for emergencies or unexpected expenses becomes easier with flexible credit options. You can remain financially agile when life throws curveballs your way.

Building or improving your credit score is possible with responsible usage of these solutions. Positive payment history enhances your credibility while giving you access to even better opportunities down the line.

Tips for Managing Your Credit Effectively with Wells Fargo

Managing your credit effectively is key to financial health. Start by regularly checking your credit report through Wells Fargo’s resources. This helps you understand where you stand.

Set a budget that includes your monthly expenses and debt repayments. Track spending habits to identify areas for improvement. Small adjustments can lead to significant savings over time.

Make payments on time, as this impacts your credit score positively. Consider setting up automatic payments or reminders in the Wells Fargo app.

Utilize available tools like budgeting calculators and financial education resources offered by the bank. These can enhance your understanding of responsible credit use.

If you’re facing challenges, don’t hesitate to reach out for help. Wells Fargo has specialists ready to assist with personalized advice tailored to your situation.

Case Studies: Real-Life Examples of How Wells Fargo’s Flexible Credit Solutions Have Helped Customers

Maria, a small business owner, found herself in need of quick funding for new inventory. With Wells Fargo’s flexible credit solutions, she accessed a line of credit that allowed her to purchase products without delay. This decision helped her boost sales during the peak season.

Then there’s Mike, who faced unexpected medical expenses. He turned to Wells Fargo’s personal loan option for assistance. The straightforward application process and competitive rates gave him peace of mind as he managed his finances during a challenging time.

Jessica wanted to consolidate her debt but was uncertain about how to proceed. By utilizing Wells Fargo’s balance transfer credit card offer, she streamlined her payments and significantly reduced interest costs. Each case illustrates how tailored solutions can meet diverse financial needs effectively while fostering customer confidence in their spending power.

Frequently Asked Questions About Flexible Credit Solutions at Wells Fargo

When exploring flexible credit solutions from Wells Fargo, many customers have questions. One common inquiry is about eligibility requirements. Generally, a good credit score and stable income can enhance your chances.

Another frequent question revolves around the application process. It’s straightforward and typically takes just a few minutes online or through an app.

Some wonder about fees associated with these credit options. Transparency is key here; Wells Fargo provides clear information about any potential costs involved.

Customers often ask how to manage their accounts effectively once they’re set up. Utilizing tools like mobile banking can simplify tracking expenses and payments.

People frequently inquire whether these solutions impact their overall credit score positively or negatively. Responsible usage usually boosts your profile over time while maintaining financial health.

Frequently Asked Questions

When exploring flexible credit solutions, many questions often arise. Here’s a look at some of the most common inquiries regarding Credit Solutions from Wells Fargo.

What types of credit products does Wells Fargo offer?

Wells Fargo provides a variety of options including personal loans, home equity lines of credit, and various credit cards designed to meet diverse financial needs.

How do I qualify for a flexible credit solution with Wells Fargo?

Qualification generally depends on factors like your credit score, income level, and overall financial health. It’s best to check directly with Wells Fargo for specific eligibility requirements.

Can I manage my account online?

Yes! Wells Fargo offers robust online banking services that allow you to monitor your accounts, make payments, and access statements conveniently from anywhere.

Are there fees associated with these credit solutions?

Fees can vary based on the type of product you choose. It’s important to review the terms carefully before committing to any agreement.

Is it possible to increase my credit limit later?

Yes! Many customers have successfully requested increased limits as their financial situations improve. Regularly managing your account responsibly can enhance your chances.

For more detailed information or personalized advice about finding the right fit for you within Credit Solutions from Wells Fargo, reach out directly or visit their website today. Your journey toward empowered spending begins here.

Find out more at: https://tinyurl.com/29mxw8am